The retail sector of the commercial real estate market remains choppy in the Las Vegas area.

In a probable repeat of 2011, some strip malls and shopping centers are expected to thrive in 2012, while others will likely face financial troubles because of high vacancy rates and tenants struggling to pay their rent.

Last year was turbulent for the local retail sector, with owners of big centers Town Square Las Vegas and the District at Green Valley Ranch turning them over to lenders amid financial difficulties.

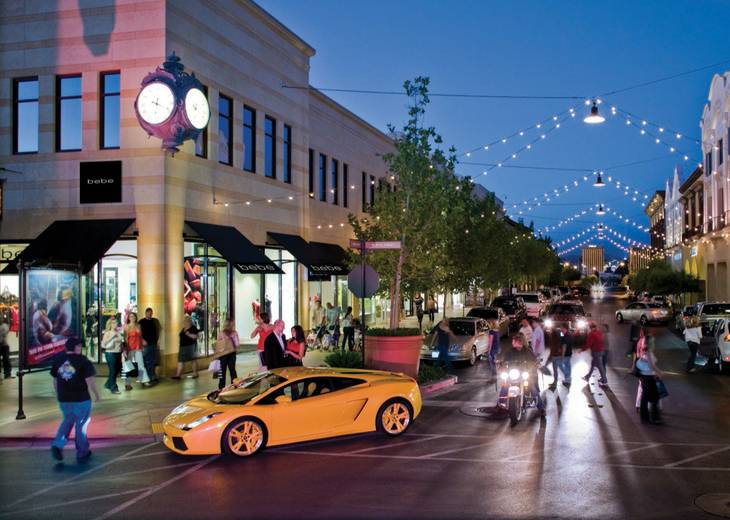

Yet 2011 also saw the opening of Tivoli Village in western Las Vegas, home to plans for continued expansion with the $350 million, 700,000-square-foot Las Vegas Renaissance indoor mall across Alta Drive on Rampart Boulevard.

Last year also saw WinCo Foods commit to the market and launch construction of two stores

John Stewart, a principal at shopping center owner Juliet Companies, said this week that as far as neighborhood shopping centers go, centers anchored by such well-known national retailers as Target, Walmart and Kohl's — all proven drivers of traffic to shopping centers — were generally doing better during the recession than properties without such nationally prominent anchors.

"This really has shown a flight to quality," Stewart said.

In the meantime, banks continue to sue underperforming centers that can’t meet loan payments, and bankruptcies continue locally in the sector.

Local advisory firm Applied Analysis last week reported the local retail vacancy rate was 10.6 percent in the fourth quarter.

That’s up from 10.3 percent in the fourth quarter of 2010, but it’s an improvement from the 10.9 percent measured in 2011’s third quarter.

Confirming Stewart’s argument about centers tending to do better if they’re anchored by national tenants, Applied Analysis found the lowest vacancy locally at 7.2 percent in “power centers’’ — places anchored by the likes of Best Buy and PetSmart.

Any way the numbers are analyzed, the brutal damage inflicted by the recession is obvious in the Las Vegas area, which is littered with empty big-box and small-store retail space.

Retail vacancies in 2006 and 2007 ran locally at just 3.2 percent and 4.1 percent, respectively. That means they’ve more than tripled in six years, and experts expect them to remain high for years to come because of broader economic problems.

"Although economic signals suggest an economic recovery is under way, the debt overhang — primarily caused by the housing market — is likely to linger over consumers for years to come. With wealth continuing to shrink due to depreciating home values and limited income growth, a return to pre-recession demand levels in the commercial retail real estate market remains years away," Applied Analysis Senior Manager Jake Joyce said in his company’s latest retail report.

Ongoing troubles in the industry were illustrated Friday when O’Bannon Plaza LLC filed for voluntary Chapter 11 bankruptcy protection in Las Vegas.

O’Bannon owns a strip mall at 2201-2267 S. Rainbow Blvd., north of Sahara Avenue, which includes anchor Sin City Furniture Co.

The mall appears to have a good amount of vacant store space, 6,000 square feet, at 2211 S. Rainbow Blvd., which was formerly occupied by Las Vegas Golf and Tennis. The bankruptcy filing notes O’Bannon and Las Vegas Golf and Tennis have been tied up in a lawsuit since 2007 over allegations Las Vegas Golf and Tennis was repeatedly burglarized and security at the mall was not adequate to prevent the break-ins.

Elsewhere around town, U.S. Bank sued two strip mall owners last month, claiming they had defaulted on their loan payments. In each case, the bank is asking that a receiver be appointed to supervise the properties and collect the rents while the bank pursues foreclosure.

One suit was filed in Clark County District Court against Las Vegas Plaza Ltd. LLC and a sister company, owner of a strip mall called The Plaza at Charleston at 5635, 5665 and 5695 E. Charleston Blvd., east of Interstate 515 and east of Nellis Boulevard. That center, which includes Anytime Fitness as a tenant, has several vacancies. The lawsuit says the center’s owners have defaulted on $4.2 million in loans.

Another suit was filed by U.S. Bank against Las Vegas Center Ltd. LLC, owner of a new but unoccupied center at 5705 and 5735 E. Tropicana Ave., east of Boulder Highway. That suit says the center owner has defaulted on a $3.8 million loan.

Neither of the shopping center owners has responded to the lawsuits.