Las Vegas’ economy is on the mend, but with foreclosures, depleted wages, shabby finances and other issues still bogging things down, it’s far from fully healthy.

And yet, more and more people are driving around town in shiny new cars.

Southern Nevadans are gobbling up vehicles amid a nationwide auto-lending boom. Business is showing some signs of slowing, but sales have roared amid cheap borrowing costs; easier financing, including for buyers with lousy credit; a hot market on Wall Street for auto-loan-backed securities; and a belief that the once-battered economy is on stable footing.

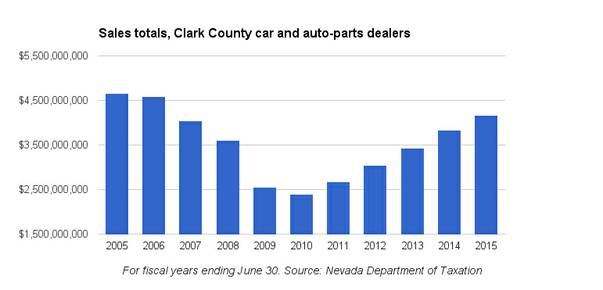

Drivers spent about $4.2 billion at Clark County car and auto-parts dealers in the year ending June 30, up 74 percent from fiscal 2010, according to Nevada Department of Taxation data. This year’s total was the highest since 2006.

“It’s been a pretty good run,” said longtime valley auto-dealer Jim Marsh, owner of Jim Marsh Kia Mitsubishi in northwest Las Vegas.

The buying binge has helped fill government coffers with tax dollars and given a much-needed jolt to the valley’s economy. But it’s raised fears that consumers again are taking on too much debt, as they did during the housing boom.

In the short term, consumer spending boosts the economy, but if it’s fueled by borrowed money and not by higher income levels, “it could be problematic down the road,” RCG Economics founder John Restrepo said.

Still, buyers feel optimistic. The valley’s unemployment rate has been cut in half since the depths of the recession, and the mass layoffs that rocked Las Vegas after the housing bubble burst have all but stopped.

Moreover, borrowing costs will remain low after the Federal Reserve’s decision last month to keep interest rates rock-bottom, where the central bank has held them since 2008 to spur economic growth.

“That all just continues to help us,” said Greg Heinrich, owner of Fairway Chevrolet, Fairway Buick GMC, Henderson Chevrolet and Pahrump Valley Auto Plaza. His new-car sales are up 8 percent year-over-year.

Findlay Toyota in Henderson sold 5,800 new cars a year at the peak, a decade ago, then plunged to 3,400 during the downturn. It’s on pace to sell 5,400 new vehicles this year, General Manager Rich Abajian said.

Low interest rates make it a good time “to buy anything with credit,” and people are more comfortable spending big because of the improved economy, he said.

Automakers also are adding technology to vehicles and changing body styles a little faster, whetting drivers’ appetite for new wheels. All told, many people who held off from buying a car during the recession "are now in the market," Abajian said.

Allen Hart, who recently moved to Las Vegas, bought a 2012 Honda Civic last year while living in Hawaii. He traded in his early 1990s Toyota Camry; the dealership gave him about $700 for it, which Hart says "was a great deal," considering the car burned a quart of oil every 30 miles.

He and his wife, Brenda, "held off as long as we could" before replacing the Camry, but when it started burning oil, they thought "it would die at any moment," he said.

Lenders are more than happy to help drivers upgrade.

The total balance of U.S. auto loans was a record $932 billion in the second quarter, up 44 percent from mid-2011, according to research firm Experian Automotive.

Credit unions, a key source of auto financing, drastically cut lending in Las Vegas after the economy crashed, but they’ve been opening their vaults the past few years.

Southern Nevada’s locally based credit unions had about $440 million in outstanding auto loans as of mid-2010. That plunged to $303 million by mid-2013 but had climbed to about $413 million by June 30 this year, according to the California and Nevada Credit Union Leagues.

Lenders cut back as they grappled with mortgage losses and rebuilt their coffers. With those tasks behind them, “that’s why you’re seeing them play catch-up,” said Dwight Johnston, chief economist for the credit union leagues.

Loans for subprime borrowers, or those with shoddy credit, also are helping fuel the resurgence nationally. Subprime and “deep subprime” now account for 20 percent of outstanding auto loans, according to Experian.

Critics say drivers might be burying themselves in high-cost debt. Clients at the Legal Aid Center of Southern Nevada often pay 29 percent interest for their loans, Sophia Medina, an attorney for the group, told state lawmakers this spring.

"Subprime auto loans are booming because they're so lucrative," she said.

Economists with credit-reporting firm Equifax, however, say subprime auto lending “deserves some recognition for weathering the storm of the Great Recession.”

The auto industry has a "bright" future and subprime loans have "greatly contributed to this bounce back,” they said in a February report, “Subprime Auto Loans: A Second Chance at Economic Opportunity.”

For now, it seems repo crews won’t be flooding Las Vegas subdivisions anytime soon. Nevada’s auto-loan delinquency rate, 0.96 percent, is down slightly from 0.98 percent a year ago and almost on par with the national average of 0.95 percent, according to TransUnion.

Clark County Credit Union, a big auto lender among local institutions, had a delinquency rate of about 5 percent, if not more, at the depths of the recession. It’s now below 1 percent, chief credit officer Chad Heese said.

But locals aren’t only loading up on car loans; they’re racking up other debts at a much faster pace than consumers nationally. Southern Nevadans’ combined credit-card balance grew more than 9 percent this past year, to $4.2 billion; the balance nationwide rose 5 percent in that time, according to Equifax.

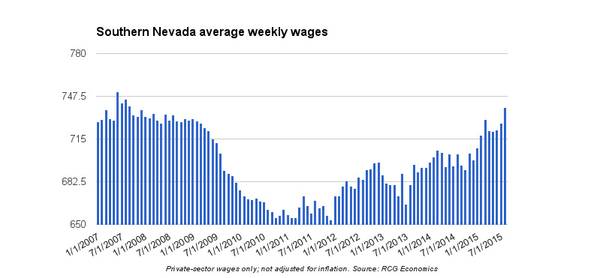

Moreover, the current 7 percent unemployment rate, despite improving, was the highest among large U.S. metro areas in August. Also, average weekly wages are rising this year in Southern Nevada but are about the same as, if not less than, what people earned in 2007 before the financial crisis, according to data from RCG Economics. When adjusted for inflation, wages are down about 15 percent from that year.

Most people have to get a loan to buy a car. But if they’re also swiping plastic time and again for clothes, furniture and other goods, they’ll run into problems, RCG’s Restrepo said.

“That contributed to the financial crisis last time around,” he said.

As it is, Nevadans’ personal finances are among the weakest in the nation.

The Corporation for Enterprise Development, a nonprofit advocacy for lower-income Americans, in January ranked Nevada’s overall economic health 48th among the states and the District of Columbia, saying many residents here “lack the most basic tools to save and build a secure economic future.”

Nevada also has some of the highest rates of residents who spend more money than they make, borrow from nonbank lenders and pay only the minimum balance on their credit-card bills, according to personal-finance website WalletHub.

Wall Street investors have been gobbling up auto loans; the market for auto-loan-backed securities grew more than 300 percent from 2010 to 2014, according to The New York Times.

But there are signs that the auto industry is letting off the gas.

Bond-ratings company Fitch Ratings says U.S. auto lenders’ asset qualities likely will weaken this year. Auto-dealer Marsh, meanwhile, said car sales valleywide dropped 4 percent in August from a year earlier. It was the first dip in two or three years and a sign that business has “plateaued,” he said.

But overall, things are “a whole lot better” than five or six years ago.

“When you’re feeling good, you want to spend money,” he said.

Eli Segall can be reached at 702-259-2309 or [email protected]. Follow Eli on Twitter at twitter.com/eli_segall.