Las Vegas’ resale housing market hit the brakes last year as investors pulled out and sellers overpriced their homes.

But now, things are picking up again amid cheaper borrowing costs and, says an industry advocate, an influx of buyers who had been blocked from new purchases due to past financial woes and investor competition.

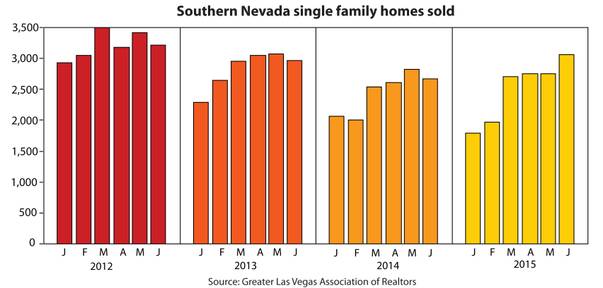

Buyers picked up 15,000 single-family homes in Southern Nevada this year through June, up 2 percent from the same period in 2014, according to the Greater Las Vegas Association of Realtors.

That follows a sales-volume drop of 13 percent in the first half of 2014 from the same time in 2013.

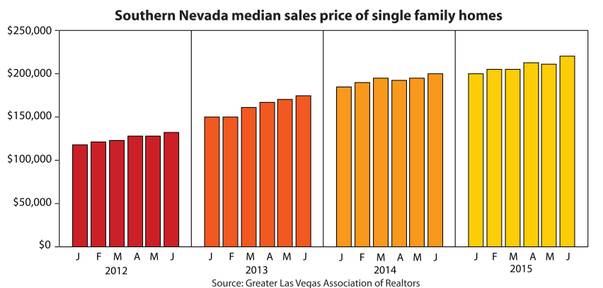

The median sales price of single-family homes climbed 10 percent from January through June, to $220,000. That’s up from an 8 percent climb in the same period last year, according to the GLVAR.

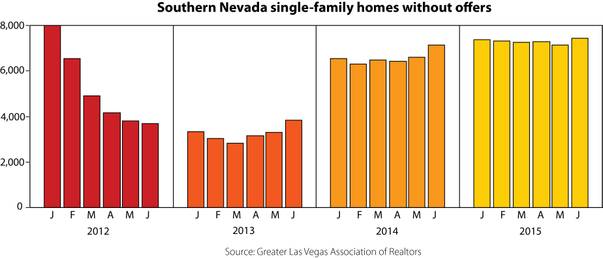

Meanwhile, the number of ignored listings, which soared the past few years, has levelled off.

About 7,400 single-family homes were listed for sale but without offers at the end of June, up 0.7 percent from January. By comparison, there were roughly 7,100 homes without offers at the end of June 2014, up 9 percent from January that year, and about 3,800 ignored listings by the end of June 2013, up 15 percent from January 2013, the GLVAR found.

The association reports data from its listing service, which largely comprises previously owned homes.

GLVAR President Keith Lynam said the market overall is “fairly stable" and that two types of buyers in particular are fueling the uptick in sales totals: people who went through a foreclosure or short sale years ago and for a long time couldn’t get a mortgage, and those who were beat out by the investors who flooded the valley for low-priced houses after the bubble burst.

Meanwhile, already-low borrowing costs have dropped further, and bankers are loosening their purse strings.

The average rate for a 30-year mortgage was 3.98 percent last month, down from 4.16 percent a year earlier, according to mortgage-finance company Freddie Mac. Additionally, U.S. mortgage lenders are expected to dole out $730 billion this year for home purchases, up 14 percent from 2014, says the Mortgage Bankers Association.

Lynam, an agent with Platinum Real Estate Professionals, didn’t say that easier lending is helping boost the market, but he didn’t rule it out.

“It certainly hasn’t hurt to get cheaper money out there,” he said.

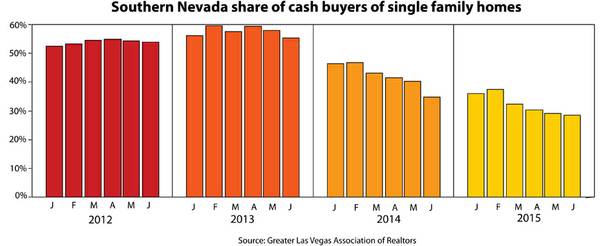

Bargain-hunting investors revived Las Vegas’ housing market after the economy collapsed, buying cheap homes, often in bulk, to turn into rentals. Prices soared at one of the fastest rates nationally, raising fears of another bubble, but investors eventually started backing out amid the rising values they helped create and a crowded rental market.

With investors packing their bags, business slowed valleywide last year. Listings increasingly were ignored as sellers, emboldened by the run-up in prices, overpriced their homes; sales volume dropped; and prices rose at a much slower rate.

Despite the upswing this year, Las Vegas is by no means problem free.

Some 25 percent of local homeowners with mortgages remain underwater, meaning their mortgage debt outweighs their home value. That’s far below Las Vegas’ peak of 71 percent in the first quarter of 2012 but still highest among large U.S. metro areas, according to Zillow.

And Nevada, with the bulk of its population in Clark County, had the fourth-highest foreclosure rate in the nation for the first half of 2015, according to RealtyTrac. One in every 126 homes statewide received a foreclosure-related filing in that time, up almost 10 percent from the same period last year.

“There are some dark clouds on the horizon,” Lynam said.