A discarded leftover from the real estate bust has been on full display in a southwest Las Vegas cul-de-sac.

On a visit this week to 5572 Airview Court, the garage door was missing, replaced by now-warped plywood; a thicket of weeds had overtaken the yard; the front door was padlocked; and a tree out front was dying, its overgrown branches sagging into the driveway and front walkway.

Last month, lenders finally seized the abandoned two-story house through foreclosure.

“Just a month ago?” next-door neighbor Adora Realica said with disbelief. “It’s been empty since we moved here three years ago!”

Lenders are ramping up foreclosures in Southern Nevada, seizing homes that in many cases likely have been in default — and possibly empty and in disrepair — for a lengthy amount of time.

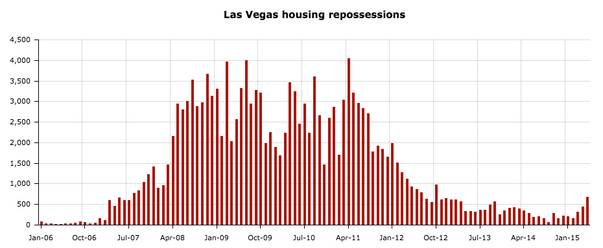

Creditors repossessed 677 homes in the Las Vegas area in May, the third consecutive month-to-month increase and the highest monthly tally in more than 2 1/2 years, according to RealtyTrac.

At first glance, the rise in repossessions seems like a return to the darkest days of the downturn, when thousands of people a month were losing their homes in the epicenter of America’s real estate bust.

But industry pros say that banks — perhaps pushed by a Nevada Supreme Court ruling last fall that upheld homeowners associations’ repo powers — are starting to clear the pipeline that filled during the recession, when new laws drastically slowed the foreclosure process on delinquent borrowers by requiring more paperwork from banks.

Foreclosures have been rising nationally, as well. Creditors seized about 44,900 homes in May, down slightly from April but more than double January’s tally, RealtyTrac found.

“This is not triggered by a fundamental problem in the housing market or economy; this is dealing with that backlog,” RealtyTrac Vice President Daren Blomquist said.

It’s unclear what, if any, effect the rise will have on Las Vegas’ housing market.

Real estate agents say banks don't want to flood the market with listings. That could push down prices valleywide, limiting lenders' ability to recoup their losses from soured mortgages. Today, even though there are more repossessions, lenders might not list the homes right away for that same reason.

In many cases, banks and hedge funds are seizing homes and giving residents an opportunity to lease their house or buy it back, Platinum Real Estate Professionals agent Steve Hawks said.

"They don't put it on the market, a lot of them," he said.

Still, the current increase was bound to happen, as foreclosures began dropping a few years ago because of government intervention, not because the economy or the housing market suddenly recovered.

"We knew people were delinquent," said Las Vegas real estate agent Linda Rheinberger, regional vice president at the National Association of Realtors.

Las Vegas’ housing market has improved a lot since the depths of the recession, thanks largely to an investor-fueled rise in home values. But it remains awash in problems.

In a sign of just how bloated the valley became during the bubble, 25 percent of local homeowners with mortgages remain underwater, meaning their mortgage debt outweighs their home value. That’s far below Las Vegas’ peak of 71 percent in the first quarter of 2012 but still highest among large U.S. metro areas, according to Zillow.

Nevada, with the bulk of its population in Clark County, has the fifth-highest foreclosure rate in the nation, according to RealtyTrac. One in every 590 homes statewide was slapped with a foreclosure-related filing last month, compared with one in every 1,041 nationally, the company says.

Also, locals increasingly are abandoning debt-laden homes, even as property-ditching declines nationally. About 34 percent of valley homes in the foreclosure process but not yet bank-owned have been vacated by their owners. That amounts to 1,942 “zombie” foreclosures, up 16 percent from a year ago, according to RealtyTrac.

Nationally, 24 percent of homes headed to foreclosure have been vacated by their owners. That’s roughly 127,000 zombie homes, down 10 percent from a year ago.

After the bubble burst last decade, banks went on a repo binge in Las Vegas and elsewhere, seizing homes en masse. But lawmakers clamped down.

In 2011, Gov. Brian Sandoval approved the “robosigning” law. It required banks to provide more paperwork, including a signed affidavit saying they have personal knowledge of a property’s document history, before seizing a house. Foreclosures plunged as the length of time it took to repossess properties soared.

It now takes an average of 447 days to foreclose on a house in Nevada after a notice of default is filed. That’s up from 386 days a year ago and 137 days in early 2007, according to RealtyTrac.

Perhaps as a result, Las Vegas has a large but unknown number of people who haven’t made a mortgage payment in years, apparently unafraid of losing their homes amid the processing delays.

Hawks said he knows a woman who owns a roughly 4,000-square-foot house in the upscale Henderson foothills community of MacDonald Highlands who hasn’t made a mortgage payment in more than 4 1/2 years. She is, however, renting out the house for nearly $4,000 per month, he said.

Hawks said he recently met a man in his office who hadn’t made a mortgage payment in seven years.

“That’s common,” he said.

Besides the robosigning law, Nevada lawmakers also passed bills in 2013 that were designed to affect foreclosures, but it’s unclear whether they’re making an impact.

Sandoval signed Senate Bill 321, dubbed the “Homeowner’s Bill of Rights,” which sought to make it easier for struggling borrowers to keep their homes. But he also signed Assembly Bill 300, which relaxed the robosigning law, making it easier for lenders to seize homes.

Banks also face continued competition from homeowners associations to repossess properties. Last September, the state Supreme Court upheld a law that lets HOAs seize homes through foreclosure when property owners are behind on their HOA dues.

Under the law, HOAs can foreclose on homes ahead of mortgage lenders, even if the associations are owed a fraction of what’s owed to banks.

Bankers are seizing more homes now in part because they “don’t want to put HOAs in control of their destiny,” Rheinberger said.

Meanwhile, the house on Airview Court is like countless others in Las Vegas: The owner got a hefty mortgage during the bubble, defaulted during the bust and ultimately lost the house to lenders.

He got a $289,000 loan from Countrywide Financial Corp. in October 2006 and had defaulted by August 2012, Clark County records show. But the lenders held off for a few years; the foreclosure sale was held May 4.

A real estate sign out front indicates the home is listed with Berkshire Hathaway HomeServices. Realica, the neighbor, said the sign was installed about a month ago — around the same time lenders repossessed the house.

Realica's husband, Larry, said someone tried to break in through the garage about a year ago.

Still, they live in a nice, quiet neighborhood, he said, and it doesn't bother him being next door to an abandoned house.

“Besides that, people here are very friendly,” he said.

Not every vacant, foreclosed home falls into stark disrepair.

The two-story townhouse at 2823 Cool Water Drive in Henderson, off Wigwam Parkway near Eastern Avenue, has been empty for at least a few years. But its condition is “not terrible,” and it hasn't been vandalized, next-door neighbor Gina Hughes said.

The last owner sank under her mortgage. She got a $215,000 loan from New Century Mortgage Corp. in December 2005 and had defaulted by April 2013, county records show.

Lenders, however, seized the home May 22, more than two years after the default notice was filed.

Hughes, herself a real estate agent with Coldwell Banker, said living next to an abandoned house — one that's attached to her home, no less — has pros and cons. She doesn't have to deal with an annoying neighbor, and she can park her car a bit in the next driveway without getting any complaints.

Still, the front yard needs work, and the house still gets daily newspaper delivery. The papers pile up, although Hughes goes over once in a while to clear them out.

Prospective buyers have stopped by to look at the house but rarely come anymore, she said.

On a recent visit, foreclosure and abandoned-property notices were taped to the front door and to a window facing the street.

“There is a lot of ghost inventory out there,” Hughes said.