Las Vegas was drowning in underwater borrowers after the housing bubble burst, with upside-down homeowners on practically every block.

Home values have since climbed from the depths, helping ease the situation greatly. But Las Vegas remains the underwater capital of America.

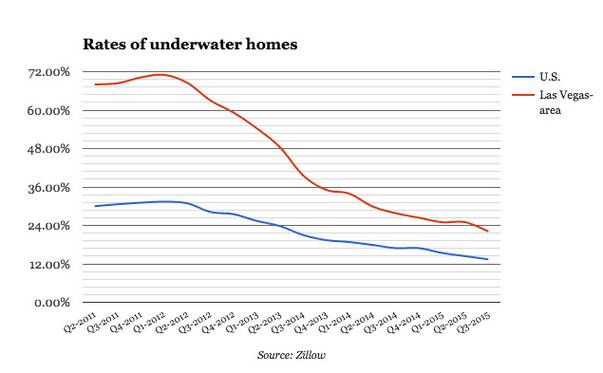

Some 22 percent of Southern Nevada homeowners with mortgages were underwater — meaning their debt outweighed their home’s value — in the third quarter last year. That’s down from 28 percent a year earlier and far below its peak of 71 percent in early 2012, according to home-listing service Zillow.

Despite the improvement, Las Vegas’ rate was highest among the 35 metro areas listed in Zillow’s report and well above the national average of 13 percent.

Overall, negative equity is “one of the most persistent reminders” of America’s real estate bust and remains “a major barrier to a full recovery in certain markets,” Zillow says.

Las Vegas — whose peak underwater rate was more than double the country's peak — seems to top the list. According to Zillow, Southern Nevada has had the highest rate of underwater borrowers in the nation for 4 1/2 years.

“There will be no magic wand or solution to immediately cure this malady,” Dennis Smith, founder of Las Vegas-based Home Builders Research, recently wrote. “Only time will cure it.”

The investor-fueled rise in home values helped many people escape negative equity the past few years. Price growth has slowed as investors backed out, which means borrowers aren’t getting above water as quickly anymore. But reflecting the drop in underwater rates, short sales no longer dominate the valley.

Homeowners completed about 2,800 short sales — in which banks agree to sell a home for less than what’s owed on the mortgage — in Southern Nevada last year, comprising 7 percent of all resales. In 2012, there were around 16,400 short sales, comprising 36 percent of the market, according to the Greater Las Vegas Association of Realtors.

Zillow chief economist Svenja Gudell spoke with VEGAS INC this week about underwater homes, their impact on the market and how Las Vegas, unlike other cities, has throngs of residents who haven’t made a mortgage payment in years because banks, bogged down by foreclosure paperwork, aren’t targeting them.

Edited excerpts:

Las Vegas’ underwater rate has come down, but it’s not shrinking as fast as it did a few years ago. Is that because price growth has slowed?

There are also not as many foreclosures as there used to be. That, with the slowing price growth, slows the drop. When homes are foreclosed upon, you take the entire balance that was underwater and wipe it clean.

How does it affect the market to have nearly a quarter of borrowers underwater?

For Las Vegas especially and other markets with negative equity, a lot of that is stored at the bottom third of home values. You’re locking down homes that are a bit cheaper, entry-level homes that are more affordable for first-time buyers. People who want to buy, can’t, and people who’d like to move up into new homes, can’t, because they’re stuck. You don’t have that flow that you usually have in a normal marketplace. As the rate-drop stalls, people thought they’d be lifted out of negative-equity and then aren’t. That doesn’t help the homeowner’s psyche, their desire to do upkeep. It’s not good for neighborhoods, for neighboring home values.

People who are underwater figure they’ll lose money selling, so they don’t bother spending money on upkeep.

They’ve already put a lot of money in and can’t fathom putting more. That’s not what you want homeownership to be.

Are there other cities with underwater rates well above the national average, like Las Vegas?

Chicago is at 20.6 percent. Detroit is still really high. Some of the Midwest cities are lagging behind. Areas of Ohio, for example, weren’t hit nearly as hard by the housing bust as Las Vegas, but negative-equity rates have been very stubborn in declining.

What about other boom-and-bust cities?

Phoenix is at 16.4 percent; Orlando, Fla., is a bit lower. Even Sacramento, which was hit incredibly hard, is now at 11.6 percent. It’s doing quite well.

Outside of a boom or bust year, what is a typical underwater rate for a city?

It’s 2 to 3 percent, definitely less than 5 percent. That’s normal. There are always some people who are underwater, and most negative equity is very shallow. Very few people are deeply underwater.

Can you explain the “effective” negative-equity rate that Zillow tracks? Las Vegas’ is 41 percent.

It’s the sum of people who are underwater and close to being underwater, or people who have less than 20 percent equity in their homes. You could be above water — for example, you bought a house with 5 percent down — but you’re considered effectively underwater. Most times, when people sell their home, you pay fees to real estate agents, movers, closing costs. You can find yourself very short of funds for another down-payment if you have less than 20 percent equity; it could deter some people from trying to sell.

Why was Las Vegas’ peak underwater rate so much higher than the country’s?

Vegas had a lot more speculation than the U.S. overall; home values climbed to astronomical levels. If you map it, there’s this huge spike up and then it crashes down. For the U.S., there was a run-up with the bubble and then it flattened out, but it was nothing like Vegas. That extreme loss in home values drove negative equity. Las Vegas also has a young housing stock; you built a ton of homes and had lots of transactions during the housing boom, at very inflated prices. Older markets in the U.S. had a lot fewer transactions during the boom; people who had bought homes in 1995, 2000, weren’t left underwater. The U.S. was much more diversified. That wasn’t the case for Vegas.

Do you think underwater rates will ever be normal here?

Las Vegas, like most other markets out there, will see negative-equity go back down to more normal, pre-bubble levels. That will simply happen over time as banks start to clean up their books and unravel empty homes standing around, or as people pay off their mortgages if they want to move. A lot of these things will get cleaned up over time, especially given the oddities in Las Vegas — the amount of empty homes and people living in homes without paying their mortgage. I think Vegas is very special in that situation. The only other places I know of where people are delinquent and have stopped paying their mortgage but know they’ll get foreclosed upon are in Florida and parts of new York. Their foreclosures go through the courts and take a long time, so people are hanging out for two to three years. Las Vegas is a bit different, though.