Nevada homeowners were slapped with a rising tally of foreclosure filings last year, bucking a nationwide drop as the state remained among the hardest hit in the country.

A total of 16,533 properties, or 1.4 percent of homes statewide, received a foreclosure-related filing in 2015. That’s up 6.6 percent from 2014’s tally, according to a new report from RealtyTrac.

The housing-data firm counts default notices, scheduled auctions and bank repossessions.

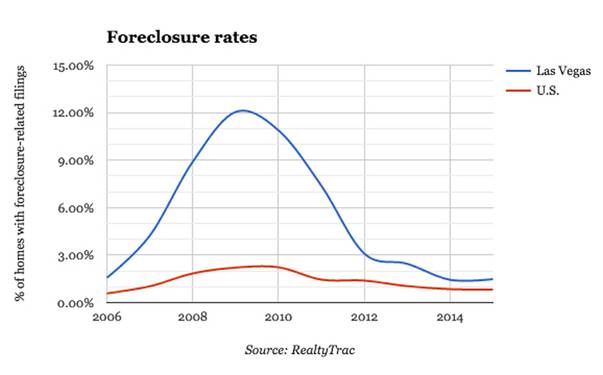

Nevada had the fourth-highest foreclosure rate in the country last year. Las Vegas, ground zero for America's real estate boom and bust last decade, also was near the top of the list among metro areas. It had the 17th-highest foreclosure rate among 214 tracked in the report.

A total of 12,482 properties — or nearly 1.5 percent of homes valleywide — were hit with a foreclosure filing last year. That’s up 3.4 percent from 2014.

Nationwide, almost 1.1 million properties — or 0.82 percent of homes — had a foreclosure filing in 2015, down 3 percent.

Banks repossessed a rising number of homes in Nevada last year, seizing properties that in many cases likely had been in default — and possibly empty and in disrepair — for a long time.

Roughly 6,190 homes were repossessed statewide last year, up 52 percent from 2014, RealtyTrac found.

Real estate pros have said that repos climbed because lenders were clearing the backlog that filled during the recession, when new laws, such as 2011’s “robosigning” measure, drastically slowed the foreclosure process by requiring more paperwork from banks.

Those processing delays left properties all over the valley in limbo — owners were behind on their mortgage but wouldn’t lose their home to foreclosure, even if they abandoned the place. Many residents stayed put and have skipped mortgage payments for years without losing their house.

Repos climbed nationally in 2015, though not as rapidly as in Nevada. Some 449,900 U.S. homes were seized through foreclosure last year, up 38 percent from 2014.

Nationwide, there was “a return to normal, healthy foreclosure activity in many markets even as banks continued to clean up some of the last vestiges of distress left over from the last housing crisis,” RealtyTrac Vice President Daren Blomquist said in the report. “The increase in bank repossessions that we saw for the year was evidence of this cleanup phase, which largely involves completing foreclosure on highly distressed, low-value properties.”

Still, the rising foreclosure activity paled in comparison to the recession, when thousands of people a month in Las Vegas lost their homes to lenders.

In 2009 alone, almost 95,000 properties — or 12 percent of homes valleywide — were hit with foreclosure filings. That had skyrocketed from about 11,270 properties — 1.6 percent of homes — in 2006, during the real estate bubble, according to RealtyTrac.