Boyd Gaming, a regional casino operator with nine properties in Las Vegas, reported its third quarter earnings today.

Company:

Boyd Gaming Corp. (NYSE: BYD)

Revenue: $738.8 million, up a fraction of a percent from $738.6 million in the third quarter of 2013.

Loss: $15.1 million, 59 percent less than the company’s $37.3 million loss in the same quarter last year.

Loss per share: 14 cents, 62 percent less than Boyd’s loss of 37 cents per share in the same quarter of 2013.

What it means:

The company’s Las Vegas properties performed relatively well for the quarter. Its locals-focused casinos reported revenues of $141.2 million, a nearly 1 percent increase from $140.3 million in the third quarter of 2013. Boyd said in a company statement that nongaming business improvements drove the revenue increase.

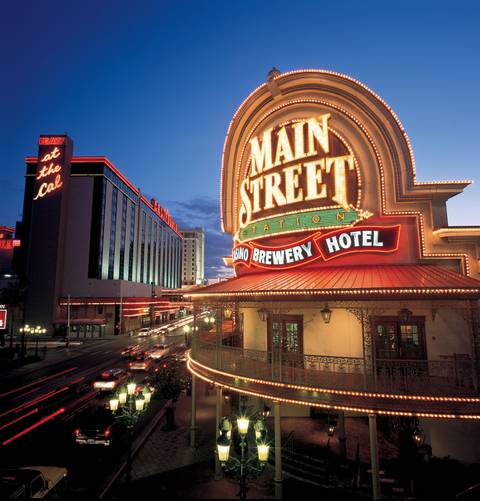

In Downtown Las Vegas, Boyd casinos reported revenue of $53.4 million, up 1.3 percent from $52.7 million in the same time period last year. Boyd CEO Keith Smith told analysts in a conference call that the company has seen “clear benefits from the ongoing revitalization of Fremont Street and downtown.” He pointed to stronger pedestrian traffic along the Fremont Street Experience as among the factors driving optimism for the outlook on the downtown market.

In Atlantic City, Boyd’s jointly owned Borgata casino reported $209.9 million in revenue for the third quarter, up 4.9 percent from the $200.1 million it brought in the same time last year. Smith told the analysts that Borgata began to see positive trends even before four of its competitors closed.

Boyd’s casinos in the Midwest and South did less well than the other properties. There, the company’s casinos reported revenues of $210.7 million, down nearly 2 percent from $214.8 million in the third quarter of 2014. Revenue in those regions was impacted by “continued softness in casual play,” the company statement said, though “operational efficiencies drove margin improvements across both segments.”

After paying down $70 million in debt during the quarter, Boyd’s total debt reduction for the year is now $165 million. Its current debt stands at $3.48 billion.

In the conference call, Smith also said that Boyd is considering forming a Real Estate Investment Trust. He said the company has spent more than $3 million evaluating the possibility, and that more extensive analysis is needed.

Quote:

“This was a solid quarter for our operations, as we improved operating margins in every segment of our business. Growth resumed in our Nevada business, as our Las Vegas Locals and Downtown Las Vegas operations both achieved positive (earnings before interest, taxes, depreciation and amortization) comparisons. We saw initial signs of stabilization in our regional business as well. … And we began work on several projects in our long-term initiative to reposition and enhance select non-gaming amenities in our portfolio. In all, we continue to make good progress executing on our strategy to drive profitable growth and increase long-term shareholder value." — CEO Keith Smith